Contents

In an active market, these stocks will high transaction volume. The first key to successful swing trading is picking the right stocks which are often volatile and liquid. Backtesting evaluates the effectiveness of a trading strategy by running it against historical data to see how it would have fared.

- In a stock market simulator, you will get filled every time, no matter what.

- You can buy stocks, ETFs, and cryptocurrencies, and test various buy-and-hold or technical trading strategies.

- The app itself might not look too attractive at first glance, but it has all the essential features you will need.

- There is a decent chance that someone in your game will luck into huge returns and be difficult to beat.

- Those are the 7 best paper trading platforms available, and they’re all free.

But most simulators can simply be downloaded and “funded” instantly and trading begins whenever the market opens. Finally, paper trading isn’t a one-time-only endeavor. Day traders should regularly use paper trading features on their brokerage accounts to test new and experimental strategies to try their hand in trading markets. Simple mistakes can be incredibly costly for day traders who risk tens of thousands of dollars in hundreds of trades per day. This makes paper trading an integral part of long-term success.

Instead, they should first drip their feet in through stock simulators and learn how to trade properly. Most swing trading strategies use technical analysis. You also might consider using a discretionary overlay. Day traders might experience amplified liquidity risks. During specific periods the bid-offer spread of an asset could expand.

You can also set up alerts for stocks that you are interested in. Like most services of its caliber, you have the option to connect your broker to TradingView and use its charts to trade directly. Perhaps the biggest advantage of using a paid service over the free one is that you get access to the official stock market data. The data that is used by free simulators is sometimes provided by third parties. As such, there is a chance that it is lagging behind the quotes from a stock exchange.

You should start real money trading at the earliest when you are profitable in paper trading over a more extended period. Day traders face intense competition when it comes to successfully identifying and executing trade opportunities. Fortunately, most online brokers offer paper trading functionality that empowers day traders to practice their skills before committing real capital. Traders should take advantage of these features to prevent making costly mistakes and maximize their long-term risk-adjusted returns and performance. In addition, swing trading relies on technical analysis.

Learn Through Free Simulation

We have done a comparison of the most popular trading simulators with replay. Some require you to choose a day and download its data. Likewise, if the market is trending upward, or sideways, you’ll want to study the patterns that work in those environments as well. Over time, the use of a trading simulator should allow you to create a trade book of high probability setups/strategies in different market contexts. One day of trading in a stock simulator can be worth weeks of training in real accounts or offline. We started using Interactive Brokers’ TWS as a secondary broker in early 2016, as it came highly recommended by another experienced trader in ourstock market community.

“It really cut down my time to research that is overwhelming for an individual investor who is working full time in non-financial area.” The software uses a Trend Following algorithm to help you identify trend, ideal buy and sell levels, and more. This is a purely mathematical and scientific approach to trading instead of guessing, hoping and consistently losing.

Practice Forex Day Trading on Live Data Anytime You Want

Similar to looking at https://topforexnews.org/ charts, TradingView offers a 1-minute chart replay. It’s great when first learning a strategy to spot patterns, but candles are produced one-by-one fully formed. Historical data is also limited on small time frames like the 1-minute chart. This is great when learning to spot patterns or when first learning a strategy. It helps with spotting patterns but it doesn’t help with practicing entry timing or calculating stop losses, profit targets, or position sizes on the fly.

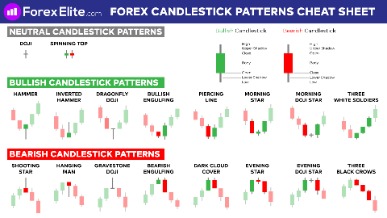

It’s a Japanese candlestick pattern characterised by a long lower wick , short real body, and little or no upper wick. It might reflect how the market will behave in a given day. You have a stronger signal by combining it with support and resistance. Expert traders are well-versed in the art of carrying out extensive technical analysis. They may have a working knowledge of different trading strategies, but they usually settle on a few strategies that they have found to be successful on a consistent basis. Swing trading is less risky than other forms of short-term trading.

In order to replay a trade, you simply choose a day from our calendar, then type the symbol you want, and press play. We love ThinkorSwim because it gives you access to over 400,000 economic data points from 6 continents. This platform contains some of the most advanced trading tools an investor can find.

Similarly, basketball teams prepare for the next game by scouting the opponent and then practicing against the offense and defense that the opponent is likely to use. Worth noting, novices will likely find Trader Workstation overwhelming. That’s why you can take our free Interactive Brokers Platform setup course if you want helping getting started with them.

When I started trading day trading forex, it was the same thing. A couple of hours of trading, and then a day of waiting before I could practice again. Yes, I could review my charts and look at historical data, but it isn’t quite the same as live price bars unfolding in front of you. A demo simulator is the best place to test your trading strategy.

Or, head on over to our blog where we cover this epic https://en.forexbrokerslist.site/. Practice makes perfect” is one of the oldest yet truest cliches out there. Our library of articles and videos will help you out.

What Is the Best Stock Trading Simulator?

The market volatility increases based on more traders becoming active. The strategy involves waiting to see if the 20-period EMA line cuts through the price action line, which can happen in two ways. After the EMA line cuts through the price line, it should stay below it even after retesting. If the EMA cuts through the price line and stays above it even after retesting, the market should continue trending upwards. However, the time duration is narrowed to less than five minutes.

This is how we trade ourselves here at The Robust Trader, and it offers many benefits over discretionary trading. What makes Wall Street Survivor perfect for beginner traders is its educational component. The Wall Street Survivor covers a lot that a budding trader could benefit from in order to advance in the markets. Not only can you learn about investing and trading, but Wall Street Survivor also provides knowledge pertaining to personal finance. TD AmeritradeTD Ameritrade is one of the most well-known brokerages currently operating.

Some buyers may start selling and take profits, which causes the trend to reverse. Now if both lines fall below the 20-mark, the asset is oversold, and more traders will choose to buy, driving the prices up. The Bolly Band Bounce strategy is executed by considering the upper, middle, and lower Bollinger Bands.

https://forex-trend.net/watchAlthough the VSE is marketed as a game by its creators, it is actually a very robust stock trading simulator. When you start on the VSE, you can either create your own game and trade on your own or join a game that is currently underway . The stock simulator is not only used by beginner traders. In fact, it is quite common to see highly experienced traders who have made a killing in the markets for years using a stock simulator. This is because a stock simulator is by far the best place to try out new strategies before you go live with them. A paper trading account and a demo account will also help you determine if the bid-offer spread or market liquidity will allow you to execute your strategy successfully.